Ddwaliro Care

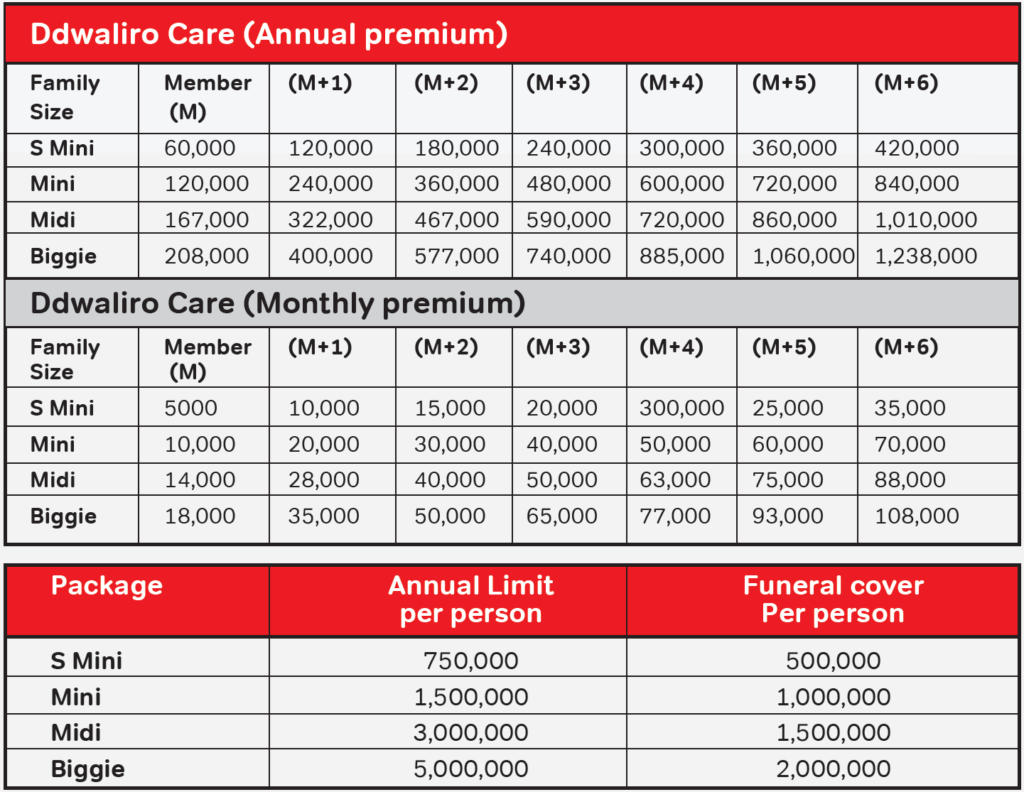

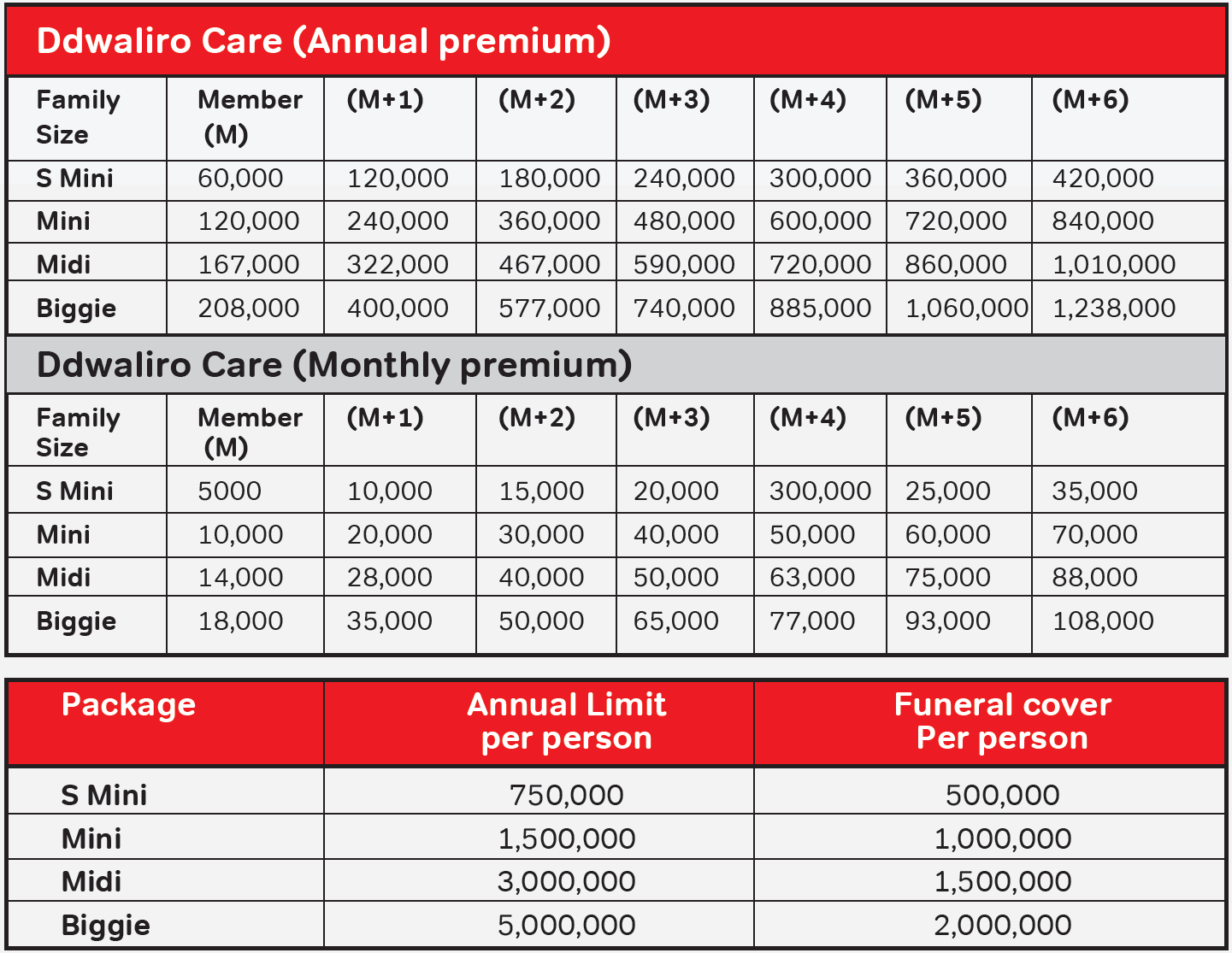

Ddwaliro Care provides inpatient insurance coverage tailored for individuals and families, starting as low as UGX 5K per month.

Enjoy peace of mind with benefits including a hospitalisaton cover, and additional funeral expense cover.

This plan ensures accessibility to over 150 AAR-affiliated hospitals across Uganda, backed by straightforward claims processing and no cash payments at the point of service.

BIGGIE PACKAGE

PLAN | BENEFIT | MONTHLY PREMIUMS |

|---|---|---|

BIGGIE | - UGX 5 Million Annual limit per person - UGX 2 Million funeral cover per person | 1 Person 18K 4 Persons 65K 7 Persons 108K |

MIDI PACKAGE

PLAN | BENEFIT | MONTHLY PREMIUMS |

|---|---|---|

MIDI | - UGX 3 Million Annual limit per person - UGX 1.5 Million funeral cover per person | 1 Person 14K 4 Persons 50K 7 Persons 88K |

MINI PACKAGE

PLAN | BENEFIT | MONTHLY PREMIUMS |

|---|---|---|

MINI | - UGX 1.5 Million Annual limit per person - UGX 1 Million funeral cover per person | 1 Person 10K 4 Persons 40K 7 Persons 70K |

S MINI PACKAGE

PLAN | BENEFIT | MONTHLY PREMIUMS |

|---|---|---|

S MINI | - UGX 750,000 Annual limit per person - UGX 500,000 funeral cover per person | 1 Person 5K 4 Persons 20K 7 Persons 35K |

How To Buy Ddwaliro Care For Yourself

How To Buy Ddwaliro Care For Your Family

How To Make A Hospital Claim

How To Renew Your Ddwaliro Care Policy

Faq

Any treatment or procedure that requires you to stay overnight in the hospital. Ddwaliro care is a health insurance policy that covers medical expenses incurred during hospitalization due to an illness or accident.

Anyone under the age of 65 years.

You can buy a cover by dialing the Airtel Money USSD code *185# Option 7 then 6, Select Ddwaliro Care and select your preferred package (S Mini, Midi or Biggie) as per the table. Pay either monthly or annual premiums.

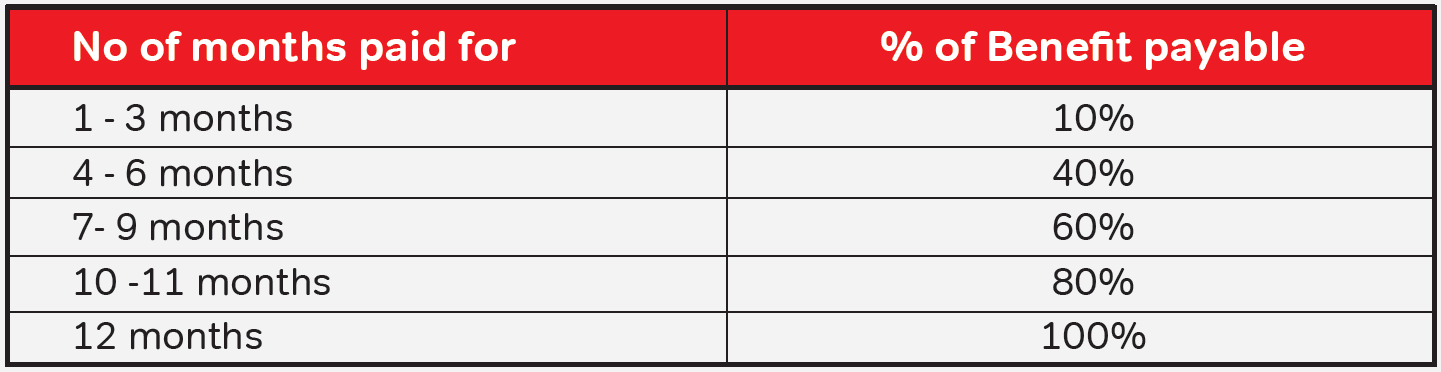

If you decide to pay monthly, make sure to Renew your payment every monthunder Renew Policy or My Policy option to remain covered and enjoy the benefits