Get Insurance Cover

Corporate Insurance

Eligibility: 10 and above principal members

From small startups to large enterprises, we provide solutions that include medical, dental, and optical benefits, emergency services, and wellness programs. These plans are customizable to ensure they align perfectly with your company’s employee benefits strategy, helping to attract and retain top talent while maintaining their health and well-being.

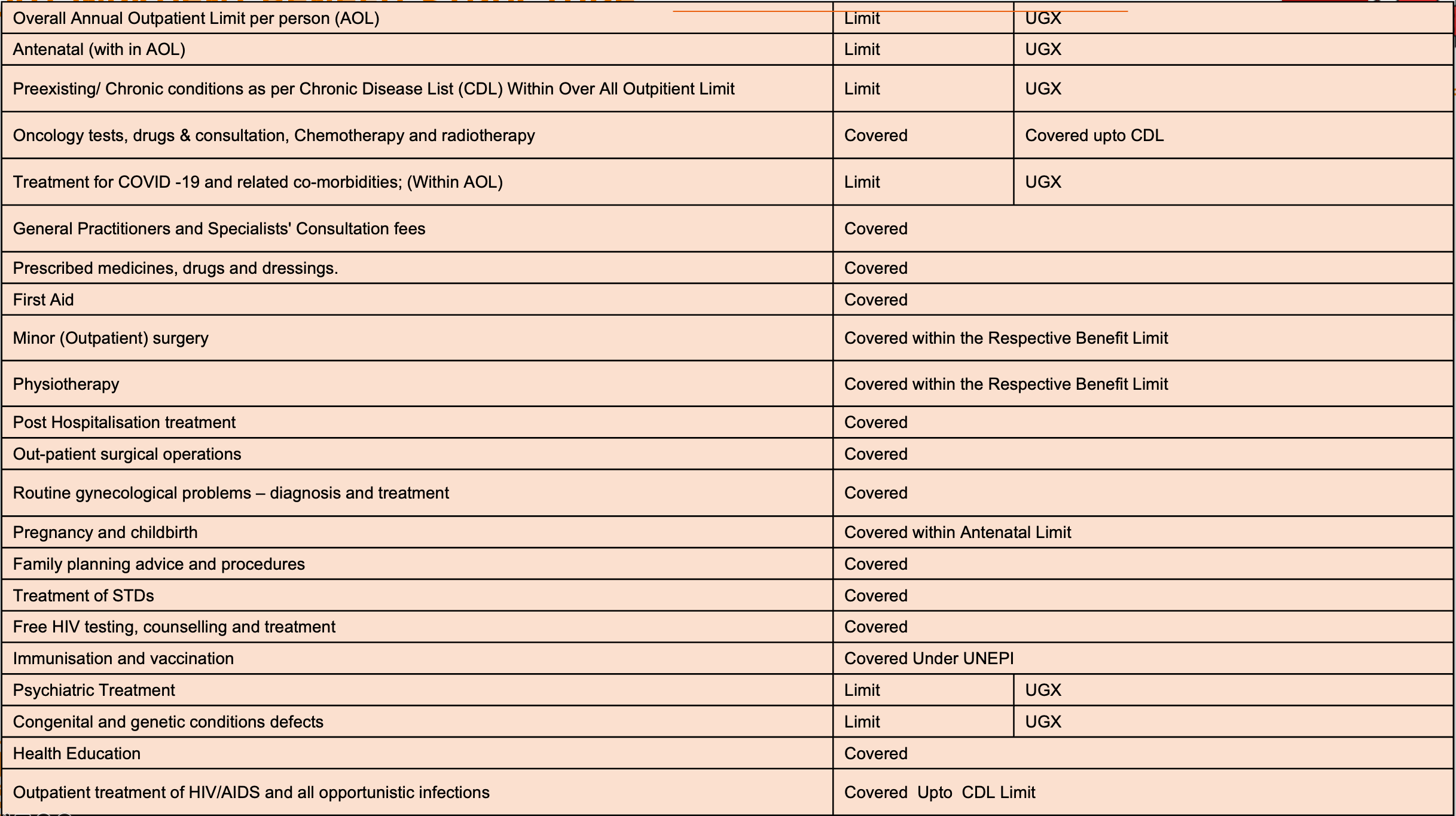

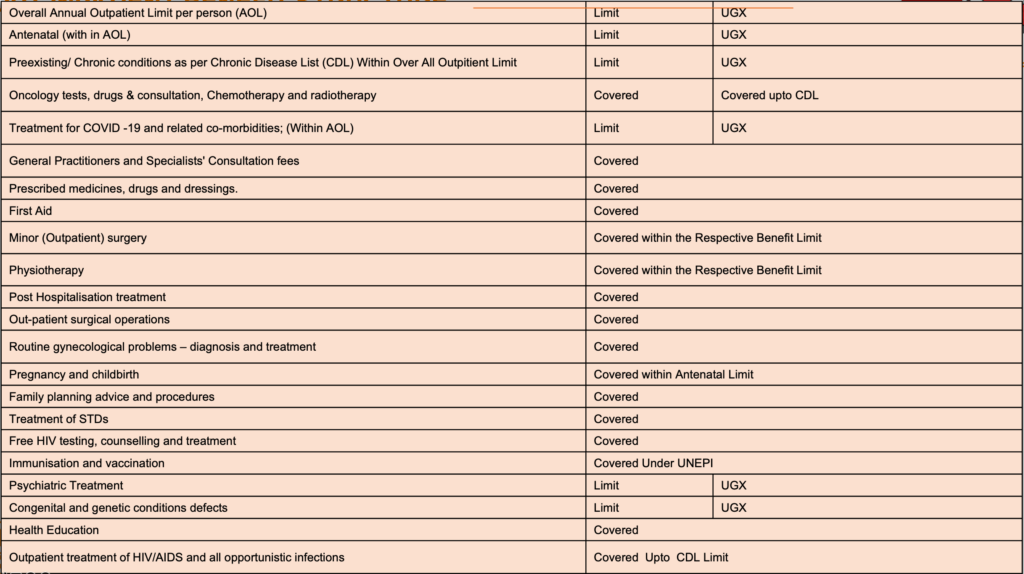

Stay proactive about your health with our outpatient benefits that cover general practitioner and specialist consultation fees, prescribed medicines and drugs, and diagnostic tests.

Outpatient surgery and treatment for chronic conditions are also covered, ensuring you receive ongoing, comprehensive care without hospitalisation.

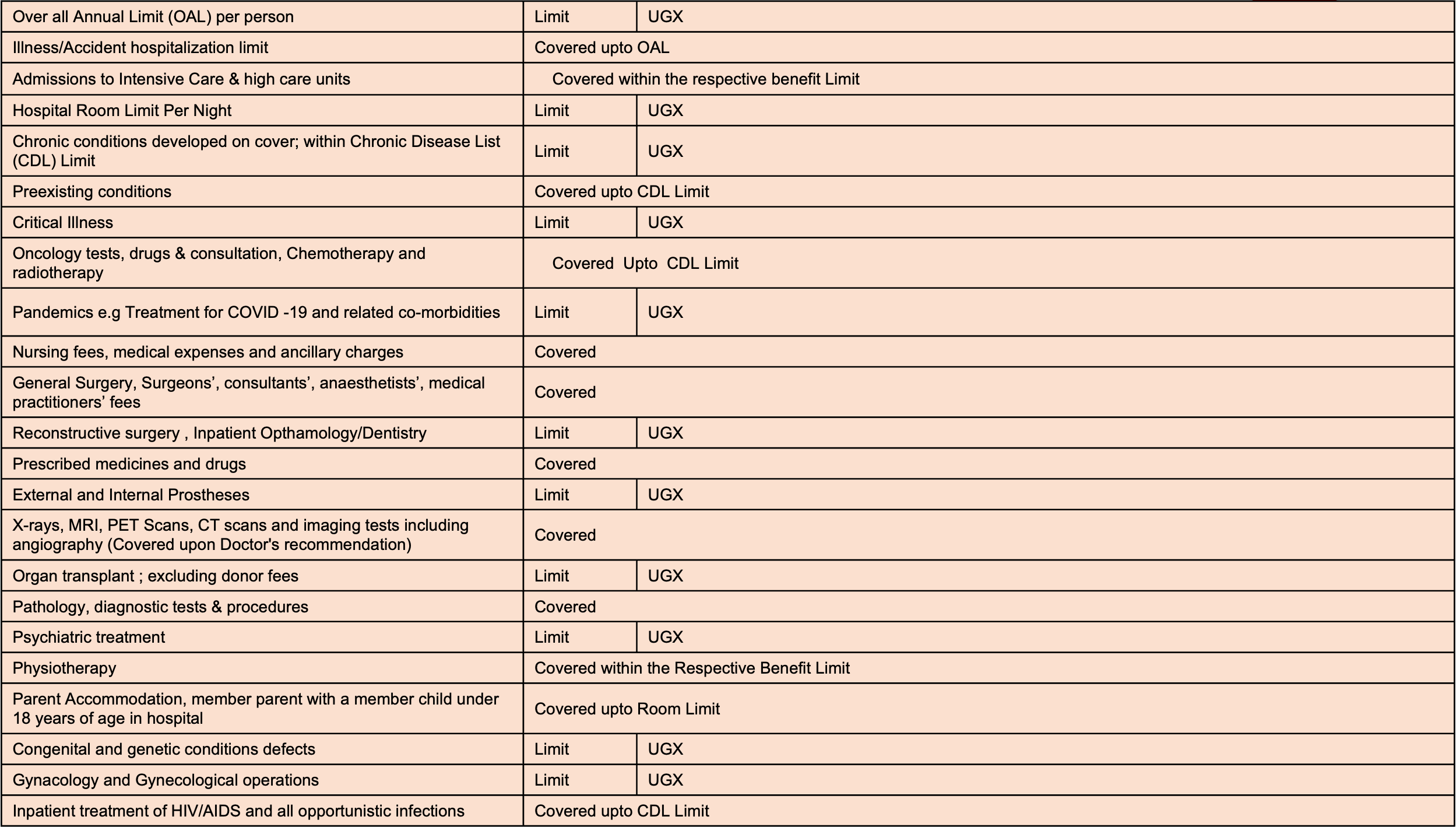

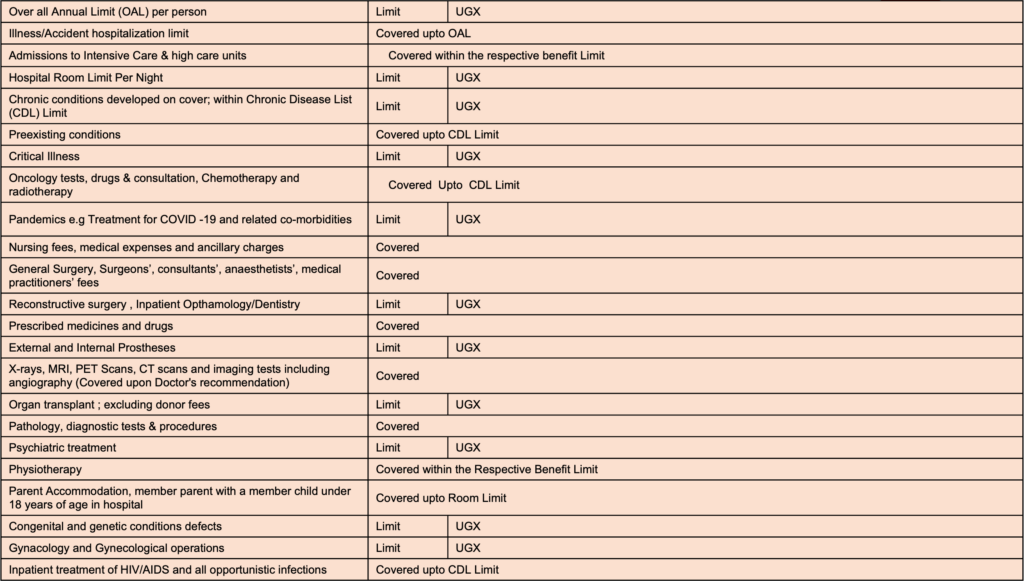

Our inpatient coverage ensures comprehensive care when you need hospitalisation. This includes room and board, all necessary medical and surgical expenses, intensive care, and access to specialized treatment facilities.

Our policies cover both accident and illness hospitalisation limits up to the overall annual limit (OAL), ensuring peace of mind during difficult times.

All benefit limits are determined by the premiums

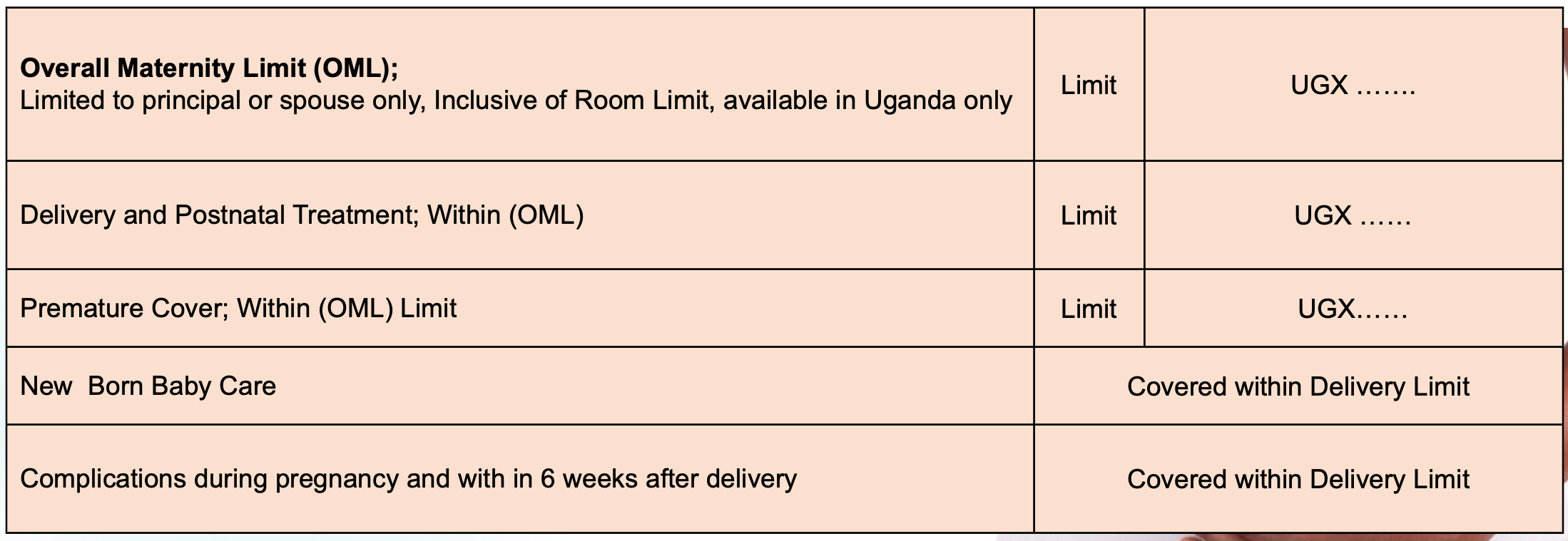

Our maternity benefits support expectant mothers from prenatal to postnatal stages, covering all necessary medical services including delivery and complications.

This benefit is designed to ensure both mother and baby's health are monitored and supported, offering peace of mind throughout the pregnancy and after.

The benefit limit is determined by the premium.

Good vision is essential to quality of life, which is why our coverage helps maintain your visual health with these optical benefits:

The benefit limit is determined by the premium

We understand the importance of oral health for overall well-being and provide coverage that supports maintaining healthy teeth and gums with these dental benefits:

We go beyond basic insurance to offer additional benefits that enhance your health and well-being, providing a holistic approach to your health insurance needs:

Designed to support the health and productivity of your workforce, our Corporate Insurance plans offer comprehensive coverage tailored to the needs of businesses.

testimonials

What Our Clients Are Saying

We partnered with AAR General Insurance Uganda Limited to provide corporate health benefits to our employees, and the feedback has been overwhelmingly positive. Their tailored plans have not only improved our employee satisfaction but also enhanced our reputation as a caring employer.

Henry Tumusiime

HR Manager

For small businesses like ours, managing costs while taking care of our team is a top priority. AAR General Insurance Uganda Limited’s SME cover addressed all our concerns with cost-effective solutions that don’t compromise on care. The coverage has been a game-changer for our small team’s morale and health security.

Birungi Anita

small business owner

Customers Also Viewed

Individual/Family Insurance

Flexible and robust health insurance options tailored to meet the personal needs of individuals and families, ensuring peace of mind for all life stages.

(Under 4 principal members)

SME Cover

Tailored solutions for small and medium-sized enterprises, designed to offer the essential protection that your growing business needs.

(4 - 9 principal members)